Have you ever felt like being pushed to ride the train on something and yet be pulled inward out of fear of failing? In this episode, Jason Wrobel and Whitney Lauritsen share their experience of being stuck in this uncomfortable space between the fear of missing out and uncertainty when it comes to investing money. At a certain point in your life, you will encounter this challenge. On the one hand, there is this urge to do something that might do wonders with it – be it investing in stocks, cryptocurrency, commodities or futures. On the other hand, there is this fear of making poor decisions that might mean losing a huge gamble on your life savings. There is an old saying that says “Fortune favors the bold,” but which is bolder: holding on to your money in an uncertain economy or taking a big swing and waiting to see what happens? What approach to money gives you the best of growth opportunities without sacrificing the need for security and safety? Listen to the discussion, reflect on it, and share your thoughts with the hosts!

—

Listen to the podcast here

Stuck Between FOMO And Uncertainty

I was telling Whitney prior to the start of this episode that I’ve been struggling a lot with major anxiety. Anxiety, stress, depression, and mental health issues that I have been dealing with for the past eight years tend to manifest in my gut. It might be TMI but I’ve been spending a lot of time in the bathroom this morning. It seems like my emotions tend to somatically manifest in my gut, maybe that’s why I’ve had many gut issues my entire life. That’s another exploration but in this episode, I am kicking it off because Whitney and I were having a text conversation as we do, and sending voice memos back and forth about how I have been feeling this anxiety around making any moves with my money. I have some money set aside. I have a little nest egg, and I feel grateful that I have any money at all right now, considering at this time the state of certain things. The anxiety I’m feeling is I feel afraid to do anything with the money right now.

I know that there are some theories that money is energy and I believe that. Sitting on a pile of cash and not doing anything with it sometimes feels like stagnation to me. It’s sitting there and I’m hoarding it. I’m afraid of doing anything with it because of the uncertainty of the world. There’s another side of me that’s like, “Things are uncertain all the time. How is this moment in history any more certain or uncertain than any other moment?” I think about my goals and intentions of wanting to grow my wealth and my money, and have assets that are creating wealth and having more compound interest working for me with stocks, Bitcoin, investments, and things like that. I feel like I’m at this point where I feel frozen because there’s the side of me that wants to feel secure and wants to feel safe.

When I look at a certain number in my bank account and I do feel a level of safety and security, it feels good. There’s the other part of me that’s like, “You’re 43. You don’t have investments like you want. You’re not growing your assets. Your wealth isn’t growing. It’s staying stuck there.” I want to make moves for the future, knowing that if I invest in an ETF, an IRA, stocks, Bitcoin or crypto, there’s no guarantee that whatever we do is going to generate wealth for us. As I texted you, Whitney, investing is gambling, whether you’re buying a house and you don’t know whether it’s going to appreciate or depreciate in the area, whether you’re investing in crypto or stocks, or you’re making hedges or you’re investing in shorts.

This is all high-level gambling. Let’s call it what it is. The anxiety around me is I’ve never felt comfortable with gambling. I was journaling about this. There’s the fear of missing out. There’s the FOMO, which I texted you about of, “Don’t miss these windows. Things are going well. There are certain ETFs, stocks and crypto that are doing great. Don’t miss the train.” It’s the rub between the FOMO and the other side of my fear, which is making poor decisions and losing this money. To start off, I’m grateful that I have anything to even consider these options, but I’m stuck between FOMO and the fear of failure. It’s psychologically a weird place to be for me right now.

It’s interesting because I feel differently or I don’t feel that way. It’s curious when you can’t relate to somebody. That’s the important thing to explore because my reaction when you were sharing this with me was, “Let me share my experiences, maybe that will help you,” but my experiences might not help you. Just because I feel a certain way or I’ve had certain experiences, it doesn’t mean that you’ll feel that way or have the same experiences. I’m curious in those moments, does it feel helpful for people to share their opinions and their experiences with you or do you just want to vent and be listened to?

It depends because on the one hand, I realized that in my friend circle and my close friends, I don’t necessarily feel that there’s any one that I feel a high level of trust or confidence in terms of investing. That’s a little bit jarring, in the sense that generally, when I have a question or I’m struggling with something, or there’s something I’d like perspective on, I feel confident in a lot of trust in my circle of friends, acquaintances, associates, and family of being able to talk to someone about a specific subject and feeling like I’m getting a high-level of feedback and perspective. When it comes to investing my money, growing my assets and where to put my money, I don’t necessarily feel at least from the immediate close circle I have that anyone’s deep in that world.

Would it be a bolder move to hold on to your money in an uncertain economy or to take a big swing and see what happens? Share on XIt makes me wonder maybe I need to make some new friends that have some expertise in these things. I’ve read a lot of books and I’m reading a lot of blogs about the stock market and crypto. I’ve been watching a lot of videos on MSNBC and the Motley Fool. I’m doing a lot of my own research, but what I’m finding is I am getting into information overload and analysis paralysis. We’ve talked about that here before. I feel like now that I’m branching into this new field of different asset classes and all these seemingly infinite number of places one can put their money. It’s no wonder people spend their entire life studying this, economists, financial advisors, hedge fund managers, stock market analysts.

It’s such a diverse dimension of life that has so many roads. It is choose your own adventure. As I sit there and I’m looking, “Do I invest in stocks, individual stocks, bonds, commodities or futures? Do I put money into Tesla? Do I put money in a Bitcoin, Ethereum?” It’s almost like I could be stuck in this analysis forever. There’s a part of me that wants to go, “Just take some money, put it somewhere and see what happens.” Who cares? You’re not going to die. You’re not going to be homeless. You’re not going to be on the streets hopefully and take a risk. I feel like my fear of taking risks in life sometimes is holding me back.

It goes into this conversation of being mindful and conservative around finances because we don’t know what the future is going to hold versus rolling the dice and taking a risk. It’s that colloquial phrase, “Fortune favors the bold.” What does that mean? What would be a bold move? Would holding onto my money in an uncertain financial economy be bold? Would taking a big swing and seeing what happens be bold? Can you see where I’m trying to digest so much information from many different sources and end up feeling stultified by it all? It’s such a whole new world for me.

As your friend, I feel a little concerned that you might put money in, and based on the way your mind works, I wonder if it would be good for your mental health to invest in stocks. Listening to you not feeling fully comfortable gambling and taking those risks, I wonder if something crashed, would that lead you to feel depressed? I have different relationships with my stocks. I have shares in three different stocks and two of them have done well. I was telling you privately that one of them has been doing well for the fourteen years I’ve owned it. I haven’t had that many experiences with that specific stock that have made me uncomfortable. I also got that stock as part of my employment. It was a stock option.

At that time, it was coming out of my paycheck. Years ago, I was a different person. It was like, “This is a little perk. I’ll try this out.” I remember when I first started working there, hearing about the stock options but feeling ignorant so I didn’t sign up for it. I regretted not signing up soon enough. I was working for the company for over six years and it took me about a year to invest, and the stock had already grown a lot in that time. Can you imagine what would have happened if I put part of my paycheck in earlier? I don’t think about that much anymore, and I don’t regret it. That has felt stable but there’s no guarantee. At any point, something could shift, something could go wrong in the media, or another company could overtake them. We don’t know. The same thing is true with one of my other stocks that’s extraordinary. The performance of that stock is mind-blowing. I wish I owned more of it and I wish I had sold one share of it and I wish that I hadn’t.

I made that decision at the time that felt best for me. That’s been my learning experience with stocks is that it has been a gamble and it has been mostly made in ignorance. I remember growing up learning a little bit about the stock market in school and being incredibly confused by it so I dismissed it. My parents invested some money through a family member who I don’t know if he still works in the stock industry or the financial industry. I remember some money being invested in my behalf. I think we might’ve sold it by now but that was my only understanding. It took experimenting for me to learn, Jason, which has been interesting and helpful, and the process of selling stock too was interesting. I would like to get anxious about it because I’m like, “Am I selling at the right time?” I was playing around with it and I’m comfortable with that. You have to decide if you’re comfortable or you need to go to those lengths to educate yourself. The question is, how much time do you spend educating yourself on these things?

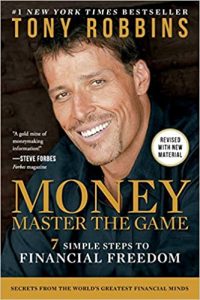

MONEY Master the Game: 7 Simple Steps to Financial Freedom (Tony Robbins)

You and I both have read at least part of Tony Robbins‘ book MONEY: Master The Game, which is a good resource to start with. That book is thick like 700 pages or something. I’m inspired to go back and read that, but even reading that book alone is a time investment. I talked about on the show how my big goal for 2021 is to pay off my credit card debt. When you were talking about investing in stock, I was thinking to myself, “That does sound great. I want to invest more in stock,” but I have to look at where my priorities are. Number one, I would like to pay off my credit card debt. Maybe after that, I’ll invest more. The other option is fully paying off my car or something. It’s important to look at all your different financial priorities, and then your financial comfort levels in order to determine this.

Lastly or the next step is turn to the experts, read the books, or take some courses. You can learn so much for free online, but you have to also think about that time investment and that overwhelm. In your case, thinking about the mental load of it, does this feel like it would be good for your mental health? Can you handle the stress of taking some money that might feel precious to you right now, invest it and potentially losing it all, or going up and down? One of my stocks, I remember having a major FOMO with it because when it became publicly available as a traded company, a lot of my friends invested in this company. This is a product that I use frequently, so I thought I should get on this board, but I didn’t jump into right away.

Everyone was excited because it didn’t cost that money when it opened, but it blew up and people made all this money in a very short amount of time, rows and rows. I kept thinking, “I should have bought it.” It then started to come down and I was excited because I had a certain amount of money. I’m like, “If this stock comes down to this number, I’m going to buy one share,” and I did. That was a few years ago and it never paid off. I think twice in the entire years I’ve had it, has it gone above what I paid for it. It seems weird to me. This company from the outside looks like the stock would do well but for some reason, it hasn’t. I only have one share so it’s not a big deal, but it’s frustrating. It’s irritating sometimes when you look and see it down. You look at the history of your money and you’re like, “Was that a stupid choice? Did I invest too late?” There’s this whole mental game that comes along with it. I’m curious, do you think that you can handle that, Jason? My next follow-up question to that is, what is your ultimate goal? Is this a long game for you? A lot of times with stock, one of the best methods is to put money in there and never take it out unless you need to.

For me, the idea of building long-term wealth and financial stability is the core of it in the sense that if I look at the assets that I have, they’re either depreciating assets, which would also be known as a liability, but I don’t have anything that’s generating wealth for me. In that sense, that’s the overall concern. If I’m just working to earn a living and I’m not having my money grow, and I’m not having wealth being generated, I’m realizing that that’s extremely concerning. It goes back to this mental gymnastics of at some point, I’m going to need to take a risk. Investing in real estate is a risk. Investing in futures, gold, precious metals or commodities, it’s all a risk.

To me, it’s not necessarily about where I’m deciding to put my money as much as you alluded to a mental game. Relationship is a risk. If you look at it this way, everything is worthwhile to a degree. I want to blow this out to a more meta-conversation. My exploration of this anxiety that I’m feeling around where to put my money or what to do with it is more about me trying to protect myself and assessing risk-reward ratio. How much in my life am I in different areas, not just financially but maybe my relationships too? Keeping myself “safe and protected” by not risking enough. Is this a conversation of me being scared of taking a risk and not dealing with the fact that I might risk something and lose, but how often do we do that in life?

We’ve done that with jobs. I’ve accepted jobs and gotten into it, and realized it was not the right fit and I had to start over. I’ve lived in 4 or 5 different cities and had to start my life over. I’ve had, years in certain relationships and have them end, and then start over. At the foundation, what I’m saying is I feel like this is a deeper spiritual and mental exploration for me of what are the associations I have around security, risk, money, trying new things, and letting go of the outcome. It reminds me of this experience years ago. This came up for as I was about to fall asleep. It was at The Longevity Now Conference back in 2012 or ‘13. I can’t remember what year, but John Robbins was a speaker. Were you at that conference seeing John Robbins?

Even with the best financial advice out there, you can never inoculate yourself against the possibility of loss. Share on XI don’t recall.

John was a keynote at this conference that I used to speak at that no longer exists in its current form called The Longevity Now Conference. In John’s keynote speech, he was talking about overcoming devastating situations in life. I remember during this talk, he was explaining his history of passing up the inheritance and taking over the Baskin-Robbins Ice Cream fortune, and his father being on his deathbed, and the emotional healing he had with his father as he was passing away. In the few years prior to John giving the speech, he talked about how he and his wife put the majority of their life savings into an investment structure that was part of the Bernie Madoff Ponzi scheme. A little bit of history, Bernie Madoff was this investor who had this Ponzi scheme that took a bunch of people’s money and essentially lost people millions and millions of dollars.

John was saying that they were completely wiped out and devastated financially. They had taken this risk on this investment based on different friends of theirs investing into what eventually became a Ponzi scheme, and they lost everything. I was sitting there looking at this man who had spent decades as an activist, an author, a speaker, and had built up this wealth, and had this family. He might have been in his late 60s, early 70s to lose the majority of his wealth, almost everything. That hit me in the heart and I remember crying because I could feel the empathy for that situation. He was saying the resilience of the human spirit. The ability for us to persevere and survive devastating situations is beyond our greatest understanding.

He was talking about how he and his wife were going back to a simpler way of living and reframing their relationship to rebuilding their nest egg and their wealth, and their approach to money. I thought we don’t know what’s going to happen. We can take the best financial advice. We can have the best financial advisor, “You need to invest in this ETF, this IRA, this crypto and that.” What that comes back to is I could make myself blue in the face, Whitney, and you know I love doing research too. That’s one thing we share. I love researching any major purchase that I make. Eventually, I realized that even if I “listened to the best advice or find a couple of advisors that I resonate with,” it doesn’t guarantee anything for me. It doesn’t guarantee safety.

It doesn’t guarantee a return. It doesn’t guarantee anything. It comes down to, we can try and think, and inoculate ourselves against chaos, loss, pain or suffering, whether that’s our interpersonal relationships, our job choices, our investments. I realized that no matter what I do in any form of relationship to money, investments, or people, there’s no guarantee of anything. There’s always the possibility of pain suffering and loss. It’s this spiritual mental game for me right now of realizing that no matter what I do, it’s not going to guarantee success. It comes back to these philosophies that we talk about of, “Follow these ten steps to being a great investor. These are the things you should do, read this blog and follow this person.”

You mentioned the Tony Robbins book. I read the whole thing. I sat through that tome, that giant book and read everything. At the end of it, the one thing I can take away from this is I feel like diversity and having your money set in different areas is the best approach because on any given day, one thing can be up and another can be down, and another thing can be down, another thing can be up. Rather than putting tens of thousands of dollars into one thing and hoping and praying, it seems that slicing up the pie into a lot of different slices and putting them in different places seems to be the approach at least at this point. What I gleaned from Tony’s book and what I’ve looked at other investment advice is diversity and variety seem to be a foundational key. For me, my relationship to money, security, safety, and what I hope for the future is part of my spiritual journey. I have no doubt about it.

Investing Money: It’s important to look at all your different financial priorities and comfort levels in order to determine where you want to put your money into.

Bringing it back to the financial side of it, Jason, you gave me a number that you said you had or could comfortably invest. I’m curious, could that money perhaps be put towards something else? Do you have all your debt paid off, for example? What do you think about this concept of paying off your debt before you invest in something else?

I do have other financial goals for sure. Much like you, I do want to pay off all my debt. I have this nest egg of cash set aside to not only pay off debt, but as either an emergency fund or as a partial down payment on a house. It’s very much this indecision fatigue of, “Do I hold onto this money because part of it is an emergency fund?” That’s probably a smart thing to have given the volatility of the world now. I also want to keep paying off my debt, increasing my credit score, and have a down payment for a house when I’m ready. If I’m paying out 15% or 20% interest on my credit card as a random example, if I take the money that I would be using to pay off that debt, I invest it in an asset that is getting a 50% return or a 100% return.

There’s crazy shit going on right now in terms of certain investments that the return is insane. Everyone’s like, “It’s not sustainable. It won’t last,” but who knows? Stuff keeps climbing. If I put my money in something that’s getting a higher percentage return than the percentage of debt that I owe on my credit, then couldn’t I make the money and get a higher yield and return on the investments versus the 15% to 20% interest rate that I’m having on my credit cards. I feel like I need to find someone and sit down, talk to them and be like, “This is what’s in my brain. What should I do?”

Maybe I do need to reach out and find a financial advisor that I can know, like, and trust, and talk to them about this because the money is sitting there. I feel like it needs to go somewhere, whether that’s a down payment on a house, investing there, paying off more debt, or putting it into different asset classes in terms of stocks, index funds or crypto. The idea of sitting there and doing nothing is very uncomfortable to me because it’s not going anywhere. The purpose of money as embodied energy is to move. If I sit there and I hoard this money and don’t do anything with it, the energy’s not moving. Wherever I put it, I feel like it needs to be doing something good. If it’s just sitting there and not moving, the energy isn’t flowing. On principle, it’s not doing anything for me.

That’s certainly a great point. This is probably where this anxiety comes from. There are so many options. Coming back to a more relatable experience that I’ve had is I felt that way with my debt because there are different ways to pay down debt. Do you pay off this credit card first? There’s the avalanche method I think it’s called where you pay off the card that has the highest interest, or you take a sum of money and you split it up amongst all of your cards, and you’re paying them all down at the same time. I felt a little bit overwhelmed but I picked a method to start with, and I picked a number. Even talking about it now, the number I chose to put towards my debt feels high and uncomfortable.

At the same time, when that payment went through, I felt empowered because I thought, “This is so great.” If you think about it, Jason, you can do calculations to see how much money you’re spending on interest and it’s so unpleasant. When I saw one of my cards has a super high-interest rate because of the way that it’s set up, because you get a certain amount interest-free for each payment. It sounds appealing, but when you look at the details of a credit card, I can’t believe I’ve been paying that much interest. I have another card that I remember I bought something on thinking I would pay it off fast and I never did. I don’t even honestly want to know how much interest I’ve paid since I did that because it probably made the purchase so much higher than it needed to be because of the convenience of being able to pay it off little by little.

In order to grow in life in any capacity, one has to be able to tolerate a certain amount of risk. Share on XThat’s the interesting thing with money and the reasons why credit cards are such a great business is because our brains think one thing, but then our circumstances can lead to something else. That’s why I’m thinking the sooner I can pay off these credit cards, the less I have that financial burden of having to pay for them every single month plus interest. What could I do with those credit card payments and that interest amount that I’m going to save? I can take that money and put it into my stock. This is one thing that you could look at, Jason, is calculate how much interest you’re paying every month or a year. As soon as these cards are paid off, I’m going to take that interest money that I saved and invest into a stock or something.

Wouldn’t that feel good? I’m not a financial advisor. This is just the way I perceive it right now, but if you’re investing in a stock and you are paying credit cards interest and all of that, you’re technically losing money on your credit card. Doing that little reframe could be something quickly you could do now. There’s more certainty in that. You know if you pay your credit cards off faster, if you take that sum of money you told me about and put that towards your credit cards, how much money would you save in interest by the end of the year?

It’s gymnastics that what we’re talking about. I don’t want to get stultified in analysis paralysis and decision fatigue here. I know I have multiple aims, purchasing a house, potentially moving out of state, having money set aside for investments and retirement, and paying down debt. Those are three massive goals. I’m feeling an excitement around it, but also fear. That’s probably normal because I feel excited about those three goals of investing more, paying down debt, and purchasing a house. Those are three things that when I think about them, I feel excited about that. When I think about the reality of, “There’s your nest egg. What do you want to do with it?”

You should keep some. You want to have something in your savings. You want to have some actual liquidity for things. I feel strongly about slicing up that pie and maybe putting it into three different buckets. Maybe talking to someone who’s been in the industry for a long time and picking their brain about this would be good rather than reading a bunch of anonymous blogs and books. It’s also confronting the feeling of failure, of making the “wrong decision.” At the end of the day, I’ve to quote Freddie Mercury, “And bad mistakes, I’ve made a few.” We’re going to “fuck up in life.” At the end of the day, if I look back on the things that I’ve done that were big doozies, did I survive them? Yeah.

Am I breathing? Do I have a roof over my head? Do I have food on the table? Do I get to bathe in clean water every day? The simple gratitude practices. If I take a swing and it doesn’t go the way that I thought, I can’t be in the mindset of beating myself up or being cruel to myself, or what if, or you should have done this, or you should have done that. I was already doing. I remember in 2012 or 2013 walking into Locali, the deli that we’ve gone to in Hollywood. I remember there was a machine. It was like a hybrid ATM where you could buy Bitcoin. I remember walking into Locali and there was this ATM-type machine where you could either take out cash or buy Bitcoin.

I remember you and I going in there like, “What’s this Bitcoin thing? Maybe I should get it.” A few years later, a mutual friend of ours who was deep into crypto was like, “You guys need to buy this.” It’s one thing that’s kept coming up over the years, over and over. I hesitated like, “This is weird. What is this blockchain, crypto shit? What is this decrypted currency that’s without borders?” I’m like, “You should have bought it back eight years ago,” but we can’t live that way. We can’t live in that mentality of shoulda, coulda, woulda. It’s a deep, dark, unpleasant hole to find ourselves in. What I’m trying to say is barring some extremely reckless choice that I make, “Will I probably be okay and survive whatever decision I make?” Yeah. I need to keep that in mind too. I can’t allow myself to be frozen. I want to make wise decisions, but I also realize that in order to grow in life in any capacity, one has to be able to tolerate a certain amount of risk. That’s a part of it.

Investing Money: We can’t live in that mentality of “should have,” “could have,” and “would have.” It’s a deep, dark, unpleasant hole to find ourselves in.

The core issue for me is safety, no matter what. You talked about my mental health and I don’t want to do anything that’s going to potentially compromise my mental health, but I also have to realize that “playing it safe” my entire life and trying to not fuck up. We talk about allowing ourselves to experiment. That’s one thing that we’ve built in this show and this brand Wellevatr on. It’s this sense of conscientious experimentation. I’m talking myself through this with you in real-time of, “I know I need to make new experiments. I want to get clear about what those experiments are before I do them,” and being unattached to the outcome, good, bad or indifferent.

That’s a healthy mentality to be experimenting. The overarching thing across all of our lives is everything is an experiment, and each of us finding our comfort zones, and whether or not it makes sense to be in that comfort zone. Whether or not it makes sense to go out of that comfort zone is going to depend on each case and it’s going to fluctuate. I want to make sure because I know that finances are mental trigger for you, Jason. You need to be very mindful whenever you make these choices because if you decide to invest money, the idea of it’s going to be sitting in there without you accessing it, due to taxes or due to the whole point of it.

Let’s say you put an X amount of money and it goes down and you need that money. Now you’re taking the money out in that case and you lost it. It wasn’t the best choice for you, whereas in the long run, it makes sense to invest money that you don’t need at that time and you don’t anticipate needing it for a while. That would be my big recommendation for you. That’s why it was easy for me to have money taken out of my paycheck. At least one of my other stock purchases that I mentioned came because I get dividends from one of my stocks. That’s something to look into because me being so ignorant about stocks, I didn’t realize that not every company gives dividends. Every quarter or something, I get money based on how much stock I own and how much money the company has made.

That’s like free money that I keep in my trading account. I’ll save it up and then I’ll buy another share of stock either with the same company or a different company. In a way, I know for sure, the more I think about this that one of the other companies I invested in, I used a dividend amount to pay for. The first stock that I bought ended up paying for another company so that I can invest in them. That method makes sense because all of this money was not something I needed when I bought it, versus for you like checking yourself and making sure, “Am I okay with putting this money away for X amount of time? Do I feel confident that I’m not going to need it and I’m not going to regret it, and it’s okay for it to go up and down for a while?” What do you think, Jason?

It’s difficult because I read other financial “experts” that are like, “You need to have this emergency fund put aside, and this is the amount of money per month based on your living expenses to cover any potential emergencies.” There’s that side of it too, I do have an emergency fund. Maybe the approach is instead of dipping into that emergency fund of liquid cash, whatever I’m earning beyond that. I don’t touch it. When I get surprise money like what you’re talking about whether that’s a stimulus check or some affiliate money or whatever it is, I can take that and throw that into investments without touching the nest egg.

There’s a part of me that’s like, “You should tolerate risk more and dip into the nest egg a little bit and put that in.” There’s another part of me that’s like, “That nest egg has taken a long time to build up.” It’s almost like there’s a part of my psyche that sounds like a fatherly voice, and there’s a part of my psyche that is almost like a child voice. It’s almost like the FOMO part or the part of me that feels like it’s missing out or missing the boat, or going to be worried about my future. It’s almost like the childlike part of my psyche. Whereas the part of my psyche that is saying, “Keep your nest egg, keep your emergency fund, and then any extra money from this point forward that comes in, put that into investments,” that feels more of like the fatherly voice.

Never make financial decisions out of the fear of missing out. Share on XIt’s interesting to identify that there are different voices in my head. That sounds a little bit strange to say but it’s true. I feel like sometimes there’s the scared, insecure, fearful child that’s worried about the future, his safety, his security, and his status in life, then there’s the fatherly side of me that’s like, “Everything’s going to be okay. You can’t make a wrong choice. It’s wise for you to have a safety net for life right now, giving the level of chaos, change and tumult that is existing in the world at this moment.”

I feel like for me, not just this situation but a lot of situations in life, where I am trying to find the balance of allowing the child inside of me to be heard, witnessed, and loved in some ways as I wasn’t when I was that age, versus maybe playing the role for myself of being a good father and learning how to parent, love myself and say, “It’s okay that you want to feel secure. It’s okay that you want to feel safe. You do have an amount of money aside that makes you feel safe. Why not anything else that comes in play with that, risk that, experiment with that and then you have the best of both worlds?” Maybe in real-time, I’m talking myself through this with you. You’re being a witness to it, Whitney. I’m curious if you resonate with that dialogue of you identify maybe this parental part of your psyche or maybe older and wiser part, versus the young girl that wants certain things. Is that something that you experienced in your own framework? Does that come up for you?

It’s helpful to think about this in terms of safety. I’m glad that you touched upon that because finances are tied to our sense of safety. I do like that idea of like, “Do I have everything covered? Is there anything additional I can do X, Y, Z with?” My mom taught me that and it’s been a mentality that’s been helpful. She says that if I ever get surprise amount of money from something, like a check I wasn’t expecting, who knows? Money can come in many unexpected ways. That certainly happened to me. What if you use that money that you weren’t expecting to receive to do things like investing or paying off credit cards? Her context was paying off credit cards. I like that concept a lot, but I wasn’t super disciplined with it. What I was in the habit of is every time I would get money from whatever source expected or unexpected, I would put it into my spreadsheet where I manage all my finances. I’d use it as a cushion for upcoming months. I’m like, “I have a bigger cushion now.” It was like I was stockpiling away because that made me feel safe. Now that I’m very determined to pay off my credit cards, I am thinking of it differently. I realized that the approach that works best for me is to give myself a certain amount that I plan on paying, unless for some reason I can’t that month.

I came up with a number I looked at and projected my finances. I’m like, “This number feels slightly uncomfortable but mostly comfortable and doable. This is what I’m going to pay off every month. If something comes up, that’s fine because I’ll still be able to meet my credit card minimums at least.” That works better for me because I’ve noticed my habits in that I’m not in the practice of taking extra money and immediately put it into my credit cards. However, I easily could become in the habit of that. I have to be more intentional about it. It’s just if we examine where we’re at mentally and what makes us feel safe, it makes me feel safer to project ahead of time with my money because I’m able to better reach my goals that way.

It’s this balance of our immediate goals, intentions or aims, and then anticipate future needs. Aren’t we doing that with many aspects of our life? We’re doing that with our finances. We’re doing that with our health. We’re doing that with our relationships. You brought up an important part of this conversation of being in the moment, and being as present as possible versus trying to create some future security. That’s ultimately what this comes down to for me is having these more immediate goals of paying off debt, and buying a home versus looking 30, 40 years from now of investing money into assets that are going to compound and grow. It does come down to, “What do I want to happen in the more immediate reality versus looking decades in the future?” We don’t know.

By the year 2050, 2060, who knows what’s going to happen, but this is part of being human. It’s trying to attend to our immediate needs for love and companionship, food, shelter, safety connection. We’re probably one of the only organisms, perhaps other than maybe dolphins or whales or certain primates, that have the cognitive ability to think into the future. We’re one of the few sentient beings here on the planet that has this idea of mortality, that has this idea of a potential future, and wanting to be safe and secure. Maybe this is something that’s wired in us. If we look back at our ancestors trying to ferment and pickle things, store food for the winter, create shelter, and take care of future generations. Maybe our desires right now in this increasingly technocratic society with cryptocurrency, self-driving cars and different investments we’ve never seen before. It might be going back to that primal urge of, “Can I feel safe and taken care of?” Not only in the moment, but maybe for my children and the generations in the future, and myself if I am going to live 30, 40, 50 more years.

As we’re wrapping this conversation, to me, this incredible mental and spiritual gymnastics of safety, security, fear, excitement, experimentation, and wanting to live in the moment, but also try and secure some future more for myself. You can see why I’m up at night. A lot is going on in my head right now. Ultimately, I must take some form of action. Inaction isn’t often a key. Some action must be taken, whether that’s saving more money, paying down the debt, putting more nest egg aside for a future house or investing in these new asset classes. Something must happen. At this moment, I’m unclear as to what that is and that’s okay. One thing is for sure, I don’t want to make decisions out of desperation and rushing them. I don’t want to make them out of FOMO. I want to make a decision out of excitement, curiosity, experimentation, and also making sure that I’m covering my ass. I’m not going to take every single dollar I have and be like, “I’m going to invest all of it.” I’m working through this process of realizing that it’s much deeper than just numbers on a page, numbers in my portfolio, or numbers on a spreadsheet. It does come down to my relationship to life. I think money and this conversation around money is a teacher and a glimpse into our life philosophies.

I’m realizing for me, that’s very much true in going deep down this rabbit hole and feeling my discomfort with it, and feeling my curiosity with it. I’m wondering what other aspects of my life are intertwined in this. No matter what I do, I realize I’m learning a hell of a lot about myself. I think there’s value in that. No matter what decision is being made here, I’m learning more and more about who I am and what makes me tick. I’m grateful for that. Any closing thoughts, Whitney, on this episode?

One thing that came to mind that I think you can use, going back to free resources for information, I bet you could learn a lot about this and/or start great conversations about this on Clubhouse. For the readers, we did a whole episode on Clubhouse when we first joined, and so much has changed since that episode. Maybe we’ll do a follow-up but this could be part of the follow-up. We did a semi-live and we went into Clubhouse and not much happened. We were super impressed at that time but still open-minded. The next day, everything shifted and I got into Clubhouse.

Now, I’m utilizing it a lot. If you don’t even know what I’m talking about, Clubhouse is a newer social network application that you can use. It’s on iOS only, meaning Apple devices. It’s based on audio chats. It’s full of amazing people with lots of interests, very educated people, a lot of professionals. I bet you, there are amazing conversations about investments happening on Clubhouse, Jason, that you could listen to. You could also start your own discussion and bring on people, and almost use that as you asking questions to the experts, and they could come on and give you answers, which is an amazing way to use a platform like Clubhouse. When you said, “This is what keeps me up at night,” I will say as the opposite side of Clubhouse, the downside to Clubhouse is it has been keeping me up at night, and not in the sense of me utilizing it so much.

This could probably be a whole separate episode since we are about to wrap this one. Clubhouse gives me anxiety that I didn’t fully realize, so much so that since I started using it, I’ve had multiple nights where I wake up in a panic thinking that I accidentally went live in my sleep. I’ve had these bizarre, almost irrational thoughts that are deep-rooted anxiety around safety and feeling like I’m accidentally doing something or exposing myself, or not fully trusting myself or something. That ties into this whole conversation. I have to be incredibly mindful of my usage of Clubhouse and how I think about it before I go to bed because it’s triggering this bizarre fear within me. The same thing is true with TikTok.

It’s interesting because on a conscious level, those platforms are amazing. One night, I woke up 2 or 3 hours after I fell asleep in this weird mental state about something happening on TikTok that doesn’t even make sense to me now that I’m awake. My brain is still utilizing those platforms even when I’m not on them. That’s a bit concerning. I’m going to throw that in there maybe as a teaser for a future episode, but I have to add that to recommending these platforms because we need to be very aware about their presence in our lives, and the pros and cons of utilizing them.

I’m glad you shared that, Whitney. It’s fascinating to hear about what keeps people up at night, doesn’t it? We could probably do a whole episode on that, of these things that come through in our subconscious or conscious minds to be looked at and dealt with. It’s interesting that’s come up for you. To the dear readers, we will definitely dive into this conversation because I feel like it wants to be explored on a much broader level. Stay tuned for that because we will have that in an upcoming episode for this episode. If you want to access any of the resources, books, articles, perspectives that we mentioned in this conversation around the relationship between money, safety, security and spirituality, you can go to our website, Wellevatr.com. If you are also on a path of wanting to explore your financial life and maybe try some new experiments with that, we’re all in the same boat. In terms of trying new things especially in 2021, I feel like one of my overarching things is to do things differently and try new things I’ve never tried before. With that mantra, we’ll see where it leads. You can find us on all of the social media platforms as well. If you want to email Whitney and myself, you can email us at [email protected]. Thanks for being with us as we explore the ins and outs, the ups and downs, the sideways movements of trying to figure out what it means to be a human here on planet Earth and maybe Mars in the future. That’s a different conversation too. Until next time. Thank you!

Important Links

*We use affiliate links in our show notes. This means we receive a small sales commission if you purchase an item based on our recommendation.

- MONEY: Master the Game

- Tony Robbins

- The Longevity Now Conference

- John Robbins

- [email protected]

- Joining a New Social Media Platform and Some Thoughts About Business Ethics – Previous episode

Love the show? Subscribe, rate, review, and share!

Join the This Might Get Uncomfortable community today: